Home Insurance:

Home insurance can seem like a big and scary thing to take on. Especially if you’re new to homeownership. Need to know that several different coverage options can be tailored to your needs. With this blog, we’ll teach you about the basics of home insurance and show you what you need to know when it comes to choosing a policy.

The Purpose of Home Insurance

Home insurance is meant to protect your home, its contents, and the people inside. It protects you against damage or loss due to natural disasters, fire, theft, etc.

It also covers any personal liability you may have if someone is injured on your property. The liability part of your policy will pay for expenses related to injuries that happen at your home.

Homeowner’s insurance doesn’t cover all risks. It only covers damage caused by specific events specified in the policy or considered accidental. This means you can’t file a claim for any damages caused by intentional acts, even if they happen at your home.

Home insurance policies cover a variety of risks, including dwelling coverage, which protects the structure and contents from designated dangers.

Liability insurance compensates for legal claims made against you because someone damages your property.

If your home is unusable due to a covered loss, an extra living expense pays for temporary accommodation.

How Does Home Insurance Work?

When you buy home insurance, you’re buying protection should something happen to your home. There are several different policies and coverages available—you should know what you need before purchasing a policy. You’ll need to take into consideration the following:

- Your deductible: this is the amount of money that you’ll pay out-of-pocket for covered damage.

- What type of coverage do you want? Most policies will cover theft, fire, water damage, etc.

- The cost of your homeowners’ insurance premium

If you have any questions about choosing the right coverage for your needs, feel free to contact your agent or company representative. They can help walk you through all the options and help you find the best policy for your budget.

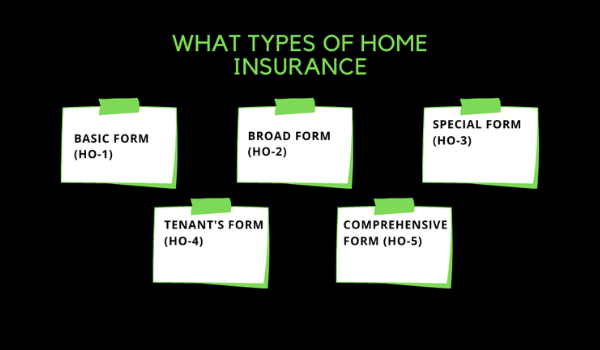

What types of home insurance are there?

There are two main types of home insurance policies to choose from, which are called HO-1 and HO-2. HO-1 covers the cost of rebuilding your home if it is destroyed by an insured event.

This type of policy is more expensive but can provide you with excellent protection to ensure that the damage will be covered if your house is destroyed. The HO-2 policy is cheaper but doesn’t cover the cost of rebuilding the house if it’s damaged or destroyed by an insured event.

It’s important to note that not all homes are eligible for coverage under either type of policy. For instance, properties with limited living space may not qualify for this type of coverage because they don’t have enough room to rebuild the home. Likewise, homes in flood zones are usually ineligible due to the increased risks associated with flooding damage.

If you want to find out what type of coverage you’re eligible for, speak with a professional who can help you find a plan that fits your needs.

What is deductible?

Your deductible is the amount of money you agree to pay when filing a claim for damage to your home. A higher deductible means lower monthly premiums but more out-of-pocket expenses when filing a claim.

Different states and companies will have different amounts listed as the typical deductible.

For example, some deductibles in North Carolina are $0, $500, or $1,000.

Some companies also offer different tiers of deductibles with varying out-of-pocket costs:

*$500-$1,000: The homeowner pays the first $500, and the insurance company pays up to $1,000.

*$1,000-$2,500: The homeowner pays the first $1,000, and the insurance company pays up to $2,500.

*$2,500-$5,000: The homeowner pays everything until they reach their most coverage limit for their house or property damage.

When Should You Consider Getting Home Insurance?

Most people think about getting home insurance when signing up for a mortgage. It’s indeed needed for you to get your loan finalized, but there are many other reasons why you should consider this coverage.

For one, if someone were to break into your house and cause damage, it would be covered under the policy. That way, if anything happens, you know that you have some money set aside to help you fix the problem.

Additionally, if something significant happens, like a hurricane or earthquake, your home insurance will cover any of the damage that is done. This is part of the package with most homeowners’ insurance packages.

Are you looking to find new flooring? You might need to call your insurer first before getting started because significant changes are not always covered by your current policy. When in doubt about what is covered, give your insurer a call before making any decisions!

Why Is It Important to Have Home Insurance?

Your home and its contents are probably the most valuable things you own. Insurance protects your property in case of a covered disaster like a fire or natural disaster.

Even if you do not have any expensive possessions, an emergency could force you to live elsewhere while your home is repaired. If this happens, need to know that your property will be reimbursed for its current market value when you file a claim with your insurance provider.

It’s also worth noting that there are property-specific policies in addition to more general types of coverage policies. These pertain specifically to certain parts of your home and the risk factors associated with them. For example,

- A standard homeowners policy will cover the structure and exterior perils related to your home, also to personal belongings inside the house in the event of theft or vandalism. Water damage from a burst pipe, fire from a faulty electrical outlet, appliances exploding due to age or a power surge, and other types of coverage are available.

- A renter’s insurance policy will cover the loss of personal items or property inside your apartment or rental unit against theft or damage caused by others living with you. It also covers loss of use of contents if you need to live elsewhere while repairs are being made.

How to Choose Your Policy

Homeowner’s insurance is something that everyone needs to have. Regardless of the type of home, you live in, And if you’re new to homeownership, it might seem like a big and scary thing to take on. But don’t worry, we’re here to help!

Many different coverage options can be tailored to what you need. It’s important to know about these so you can make the right choices for your situation and your budget.

The first step is to determine whether you need actual cash value or replacement cost coverage. Real cash value is usually less expensive but will only pay out the cost of repairing or replacing damaged items with those same items, not necessarily their current market value.

Replacement cost coverage will pay for an item if it’s still available (for example, a sofa might be discontinued). It will cover the costs up-front without having to wait until after damage occurs.

Next, figure out how much your property is worth. If the cost of replacing or repairing would exceed this amount, then you’ll want replacement cost coverage (or even better, exceeds actual cash value).

Lastly, consider any additional factors affecting your home’s safety and security—like its location in a flood.

5 Best Home Insurance Companies

| Company Name | Market Cap |

| Berkshire Hathaway Inc. | $605 billion |

| Ping An Insurance Company of China | $218.9 billion |

| China Life Insurance Company | $152.3 billion |

| Allianz SE | $107.4 billion |

| Chubb Limited | $71.9 billion |

1. Berkshire Hathaway Inc.

Berkshire Hathaway Inc., Warren Buffett’s investment firm, tops the list of the ten finest house insurance companies. Property and casualty insurance and reinsurance, electricity and energy, freight rail transportation, banking, manufacturing, and retailing services have all been founded by the company. The Omaha-based holding firm oversees more than 60 companies, including GEICO and the supermarket behemoth Kraft Heinz.

The corporation intends to spend $8.3 billion on new electricity generation. This blackout insurance is intended to protect Texas from another power outage. The corporation intends to develop ten power plants around the state by November 2023, each with a week’s worth of natural gas storage on-site in case of supply problems.

Since the beginning of the year, BRK-A has gained 14.11 percent, bringing its year-to-date gains to 36.31 percent. On April 9, its Class A shares, the most costly in the stock market, ended at $400,000 per share.

2. Ping An Insurance Company of China

Ping An Insurance Company of China is ranked second on our list of the top ten best house insurance companies. Ping An, China’s first joint-stock insurance firm, was founded in 1988 in Shenzhen, Guangdong Province. With over 214 million retail clients and approximately 579 million Internet users, Ping An is one of the world’s largest financial services organizations.

Insurance Asia News named Ping An Property & Casualty “Digital Insurer of the Year” in their Awards for Excellence 2020. Ping An Property & Casualty’s “groundbreaking programs,” which fund technology such as online claims and mobile services, include artificial intelligence, data gathering, image recognition, and big data.

In 2020, the company’s net profit was $24.4 billion. The stock has increased by 22.9 percent in the last year.

3. China Life Insurance Company

China Life Insurance Company ranks third in our list of the top ten best home insurance companies. Through its subsidiary, the firm is one of the most renowned properties and casualty insurers in the world. The company, based in Beijing, China, specializes in life, annuity, accident, and health insurance. The state-run insurance business brags about its enormous nationwide distribution network, which comprises 740,000 agents selling individual insurance, 19,000 agents selling community insurance, and 71,000 agents selling at bank counters, with a total customer base of approximately 200 million.

In 2020, the company’s total revenue increased by 10.3 percent, to $122.7 billion. LFC’s stock price has risen 3 percent in the last year.

4. Allianz SE

Allianz SE, a German insurance company, is fourth on the list of the top ten house insurance firms. Money magazine’s Best-Value Home and Contents Insurance Award 2021 has been awarded to a Fortune Global 500 firm. Allianz, founded in 1890, is an international insurance firm that provides property and liability insurance as well as asset management services. Allianz SE, Europe’s largest insurer, just acquired Aviva Poland for $2.9 billion in cash. It is expected to be finished in 12 months, subject to regulatory permission.

The company’s property and casualty segment revenue increased 0.4 percent to $70.6 billion in the fourth quarter of 2020. The stock has increased by 32.7 percent in the last year.

5. Chubb Limited

Zurich-based Chubb Limited is ranked fifth among the top ten home insurance companies. Chubb Limited is a prominent commercial lines insurer in the United States and one of the largest property and casualty firms in the world. Through its regular activities in 54 countries worldwide, Chubb provides business and personal property and casualty insurance, supplemental health insurance, reinsurance, and life insurance to a diversified community of consumers.

Chubb’s full-year net income in 2020 was $3.53 billion, a decrease from $4.45 billion the prior year. CB’s stock has risen 30.8 percent in the last year. Chubb has a buy rating from MKM Partners analysts. At the present price of $160.69, there is a 30.69% upside potential.

If you enjoyed this post, please share it and provide feedback: you can also read my other articles: Buy a Home: Considerations and Tips for Finding the Right Place